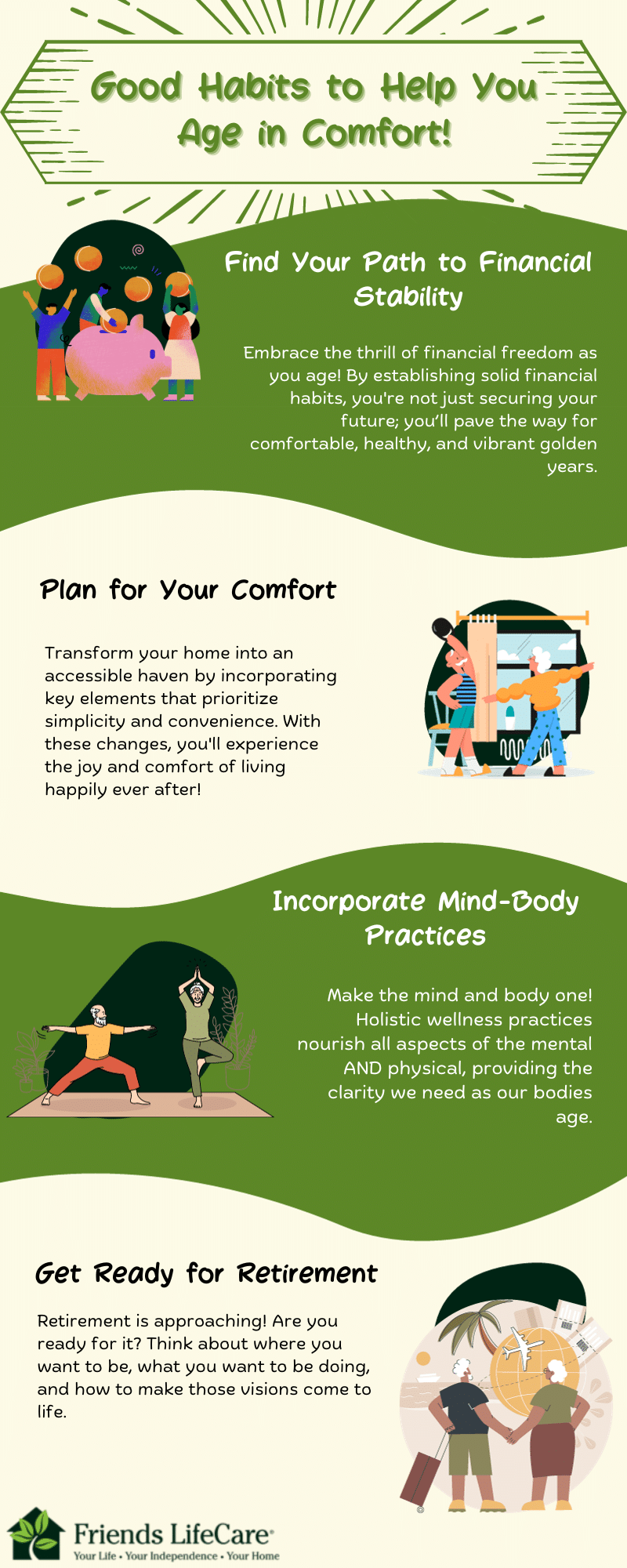

Habits to Stay Healthy, Well, and Independent As We Age

As we journey through life, the sands of time steadily shift beneath our feet. Aging is an inevitable process, a path we all walk down. But how we age — whether we simply endure or truly embrace it— largely depends on the steps we take and habits we cement as we continue down our path.

Aging doesn’t have to mean diminishing. With the proper practices in place, it can be a time of profound growth, abundant health, and increased independence. We’ll delve into specific habits that help us navigate the aging process with resilience and empower us to live out our later years with the same vitality and autonomy we enjoyed in our youth. Let’s redefine aging together and transform it into a continuous journey of self-improvement and fulfillment.

Focus on Your Finances

Financial security is a crucial element of aging well and maintaining independence. As you approach the life-changing milestone of retirement, financial stability should be something you put at the forefront. It’s never too late to make adjustments to improve your financial health. Here are some key habits to consider:

- Consider Delaying Social Security: By postponing the collection of benefits, retirees can increase their monthly income, as Social Security benefits rise with each year of delay up to the age of 70.

- Take Stock of Your Assets: It’s imperative to know every detail about what you own, including things like savings and investments, to start your retirement off on the right foot.

- Reduce Debt: High debt levels can be a significant burden in retirement. Aim to pay off high-interest debts as soon as possible, and consider working with a financial advisor to develop a debt reduction strategy.

- Diversify Investments: Diversification can help protect your savings from market volatility. A mix of stocks, bonds, and other investments can provide a balance of growth potential and stability.

- Plan for Health Care Costs: Health care can be one of the biggest expenses in retirement. While options like long-term care insurance exist, you can also transfer risk to options like a Friends Life Care membership plan to simplify your financial situation.

- Keep Learning: Financial markets and tax laws change frequently. Stay informed by reading financial news or working with a financial advisor.

Staying up to date on your finances can set the tone for retirement and create a solid foundation for a secure, independent, and comfortable life as you age. Remember, it’s not just about having enough money to live on — it’s about having the resources to enjoy your golden years and handle whatever comes your way.

Planning for Accessibility and Comfort in Your Home

As we age, our homes — our cherished personal spaces — may need to adapt to our changing needs. Start by considering potential mobility challenges that might arise in the future. You may want to install grab bars in the bathroom, ensure your home handrails on both sides of the stairs, or rearrange furniture for unobstructed pathways. It’s also wise to consider the maintenance your home requires. A large garden might be a joy now, but it could become a burden later on. Think about hiring help or downsizing to a place that is a low-maintenance living option.

Additionally, invest in good lighting to prevent falls and make daily tasks easier. If possible, plan for a first-floor bedroom, and consider a walk-in shower for easy access. Smart home technology can also enhance your independence with tools such as automatic timers for lights, voice-activated devices, and remote control window shades. No matter what you focus on, the goal should be to focus on accessible living solutions.

Holistic Wellness: Incorporating Mind-Body Practices

Aging is not just about the passing of years; it’s a holistic process that involves our bodies, minds, and spirits. To age healthily and well, many people turn to holistic health habits that nourish all aspects of our being. In-home holistic health programs can provide guidance and stability and help adults enjoy the best life has to offer as they age.

Programs can help you start with regular physical activity — from brisk walking to yoga — that keeps your body strong, flexible, and heart-healthy. Mental stimulation is equally important and prioritized. Engage in activities that challenge your brain, like puzzles, reading, or learning a new skill, to keep your mind sharp. Don’t forget emotional wellness. Cultivate relationships, engage in social activities, volunteer, or adopt a pet to keep loneliness at bay. Mindfulness practices such as meditation or deep-breathing exercises can also help reduce stress and enhance mental clarity.

Retirement Planning: Envisioning Your Golden Years

Establishing good retirement planning habits can help you navigate this new phase of life with ease and confidence. Start by setting clear financial goals for your retirement years. Beyond finances, think about your lifestyle in retirement. Where do you want to live? What hobbies or activities do you want to pursue? Do you wish to work part-time or volunteer? Planning for these aspects of retirement or adjusting your lifestyle to fit these avenues better can greatly enhance your quality of life, providing purpose and enjoyment. Remember that retirement planning is a journey, not a destination. Regularly review and adjust your habits and plans as needed to ensure they align with your evolving goals.

Embrace a Brighter Future Today

Aging well can be within your reach. Simple habits, like regular physical activity, can profoundly impact your health and independence as you age, but taking things a step further can make an even bigger difference. Focusing on habits that embrace financial security, holistic wellness, and planning for accessibility are just some ways to promote a healthy and comfortable future. And by partnering with Friends Life Care, you can make it MUCH easier to cultivate these habits! Contact Friends Life Care to start today and set your future up for success.